Credit Report vs Credit Score

Before you start improving your credit score with Credit IQ, it's important to understand what your credit report and credit score are.

Read More11/23/2021

Tracking your credit score is easier than ever with Credit IQ! Get notifications on credit changes and monitor your progress as often as needed with no impact to your credit score. Along with tips on improving your credit score and finding the best rates for your needs, Credit IQ is your newest tool for improving your financial wellness.

This is a free service provided to our members. Get your daily credit score, monthly credit report, and credit monitoring and more!

Never miss a thing and empower your financial decisions by accessing your score anytime.

Turn your credit into an engine for financial success and discover how much you can save by refinancing with us.

Use the interactive tool to simulate how your score may change with new credit inquiries, pay-offs, on-time payments and more!

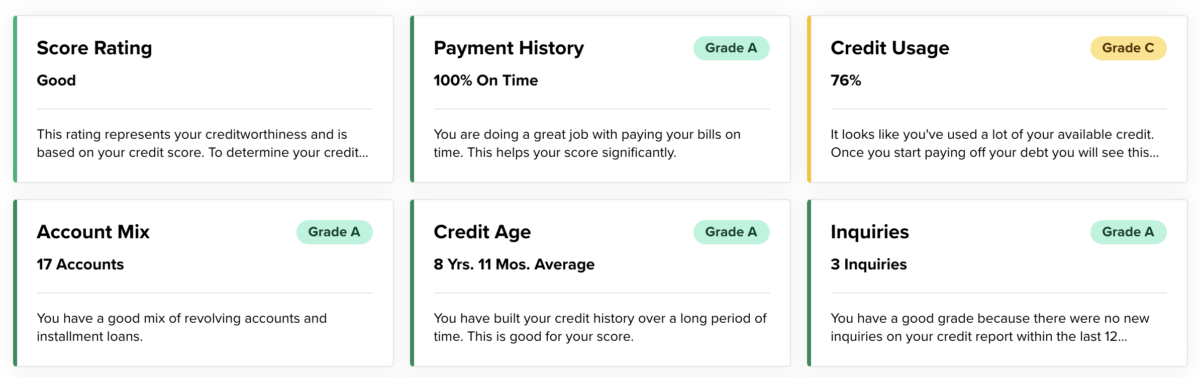

Your report card within Credit IQ includes your full credit report and shows each category that makes up your score. Each category provides your grade and recommendations for ways to improve your score.

Getting started is easy. Log in to online or mobile banking and you will find Credit IQ:

No. Credit IQ is free and no credit card information is required to sign up.

Your score will be updated automatically each week.

No. Checking Credit IQ is a “soft inquiry”, which does not affect your credit score. When your credit is pulled when applying for loans, a ‘hard inquiry’ is made.

No, Arkansas Federal Credit Union uses its own lending criteria and credit bureau reports for decisioning a loan. Credit IQ is an educational program that can help you manage your credit so when it comes time to borrow for a big-ticket purchase—like buying a home or car—you understand your credit health and can qualify for low interest rates.

Credit IQ uses bank-level encryption and security measures to keep your data safe and secure. Arkansas Federal will never share your personal information with non-affiliates for marketing purposes.

Credit IQ pulls your credit profile from TransUnion, one of the three major credit reporting bureaus, and uses VantageScore 3.0, a credit scoring model developed collaboratively by the three major credit bureaus: Equifax, Experian, and TransUnion. This model used aims to make score information more uniform between the three bureaus to provide members a better picture of their credit health.

There are three main elements to consider in a credit score: the scoring model used, the information reported, and the date the score was pulled. While most of the information collected is similar, there may be some slight differences. No matter what credit bureau or scoring model is used, consumers fall into specific credit ranges: Excellent 781–850, Good 661-780, Fair 601-660, Unfavorable 501-600, Bad <500. For more information, visit transunion.com/credit-score

Credit IQ makes its best effort to show you the most relevant information from your credit report. If you identify an error, you should start by obtaining a free credit report from Annual Credit Report.com, and then pursuing action with each bureau (Experian, Equifax, and/or Transunion). Each bureau has its own process for correcting inaccurate information but every user can “File a Dispute” by clicking on the “Dispute” link within Credit IQ. The Federal Trade Commission website also offers step-by-step instructions on how to correct errors by contacting the bureaus.